Denver's competitive real estate market demands strategic financing for investment properties. Conventional loans cater to strong credit borrowers with flexible terms, while government-backed FHA or VA loans offer lower rates and lenient down payments. Alternative options like hard money loans provide speed but higher costs. Diversified financing empowers investors to capitalize on Denver's opportunities with enhanced agility. Investment property loans denver are key to navigating this thriving market.

Looking to invest in Denver’s vibrant real estate market? Understanding long-term financing options is crucial for turning your property dreams into reality. This guide navigates the landscape of investment property loans in Denver, offering insights on conventional loans and their benefits, government-backed financing, and alternative methods. Whether you’re a seasoned investor or just starting, uncover secure and tailored funding solutions to propel your real estate journey forward. Explore these options and unlock the potential of your Denver investment property.

- Understanding Long-term Financing for Investment Properties

- Exploring Conventional Loans and Their Benefits in Denver

- Government-Backed Loans: A Secure Option for Real Estate Investors

- Alternative Financing Methods for Denver's Investment Property Buyers

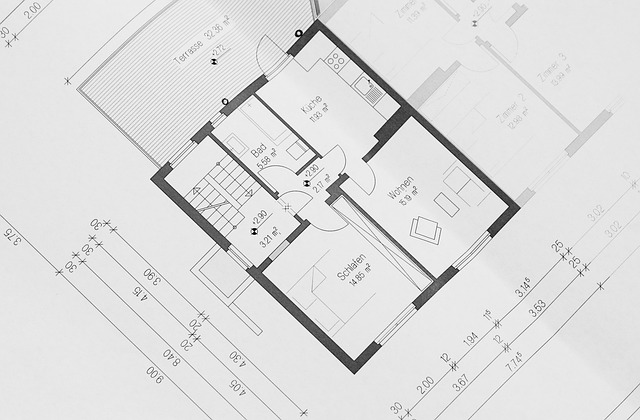

Understanding Long-term Financing for Investment Properties

Understanding long-term financing options is crucial for anyone looking to invest in Denver’s competitive real estate market. Investment property loans in Denver, like elsewhere, come with various terms and conditions, but they’re designed to cater to the unique financial needs of landlords and property developers. These loans are typically structured for periods exceeding one year, offering borrowers a more extended repayment schedule compared to short-term financing options. This approach allows investors to spread out their expenses over an extended period, making it a popular choice for purchasing, renovating, or refinancing existing investment properties.

Long-term financing for investment properties in Denver often includes conventional loans, jumbo loans, and government-backed mortgages like FHA or VA loans. Each type has its own set of eligibility criteria, interest rates, and terms, catering to different investor profiles and project scales. For instance, conventional loans are suitable for borrowers with strong credit and a down payment, while FHA loans provide more flexibility in terms of down payment requirements and credit scores. Understanding these variations is key to selecting the most appropriate financing option for your investment strategy.

Exploring Conventional Loans and Their Benefits in Denver

In Denver, as with many growing cities, investing in property has become a popular venture for those looking to grow their wealth. When exploring financing options for this endeavor, conventional loans often stand out as a reliable and beneficial choice for prospective investors. These loans, offered by banks and lending institutions, are accessible to individuals who meet specific criteria, typically including a strong credit history and stable income. One of the key advantages is their competitive interest rates, making them an attractive option for those seeking to maximize returns on their investment property in Denver.

Denver’s vibrant real estate market presents ample opportunities, and conventional loans provide investors with the necessary capital to seize these chances. These loans offer flexibility in terms of repayment periods, catering to various investor preferences and financial goals. Whether it’s a short-term strategy for quick flipping or long-term rental income, conventional investment property loans in Denver can be tailored to fit individual needs. This accessibility and adaptability make them an excellent starting point for anyone looking to enter the lucrative world of real estate investment.

Government-Backed Loans: A Secure Option for Real Estate Investors

Government-backed loans offer a secure and attractive financing option for real estate investors in Denver, CO. These loans are insured by federal agencies like Fannie Mae and Freddie Mac, reducing the risk for lenders and often resulting in more favorable terms for borrowers. For investment property owners or those looking to purchase rental properties in Denver, this means lower interest rates, flexible down payment requirements, and longer repayment periods compared to traditional bank loans.

One of the key benefits is the consistent availability and stability these programs provide. Whether you’re a seasoned investor or just starting, government-backed loans can offer peace of mind and help navigate the competitive investment property market in Denver. This type of financing is particularly appealing for those seeking long-term rental income or planning to hold properties for an extended period, as it allows for more predictable cash flow and easier access to capital.

Alternative Financing Methods for Denver's Investment Property Buyers

Denver’s investment property buyers have a growing array of alternative financing methods at their disposal, beyond traditional bank loans. Access to flexible funding options has expanded significantly in recent years, driven by a surge in non-bank lenders and innovative financial products tailored for real estate investors. This shift offers several advantages, notably lower barriers to entry, quicker turnaround times, and customized terms that align with the unique needs of investment properties.

One prominent alternative is hard money loans, which are typically provided by private lenders or lending networks. These loans, often secured by the property itself, offer speed and simplicity but usually come with higher interest rates and fees compared to conventional mortgages. Additionally, investors can explore crowdfunded real estate platforms, where they can access capital from a network of individual investors, providing a more democratic approach to financing. With the right strategy, understanding these alternative financing methods for investment property loans in Denver can help buyers navigate the market with greater agility and confidence.

When it comes to securing an investment property loan in Denver, understanding your financing options is key. From conventional loans offering competitive rates to government-backed programs providing security and flexibility, each method caters to different needs. By exploring these diverse avenues, real estate investors can navigate the market effectively, make informed decisions, and unlock lucrative opportunities in Denver’s vibrant property landscape. Whether you’re a seasoned investor or just beginning, choosing the right long-term financing strategy is essential for achieving your real estate goals.